Making Tax Digital is coming soon!

It will will eventually affect us all, businesses including property investors will have to initially file their accounts quarterly and then ultimately monthly.

For many this will be a huge shift from annual accounts and self assessment returns.

HMRC will be able to estimate your tax each time you submit a return.

The government have confirmed that taxpayers will be given a period of at least 12 months before they will be charged any late submission penalties in relation to their Making Tax Digital for Business obligations.

Making Tax Digital – sanctions for late submission and late payment is open for you to respond until 11 June. The consultation seeks views on three possible models for late submission penalties and provides an update on late payment penalty interest.

Model A – the Points Based System

Model B – Compliance Reviews with Penalties

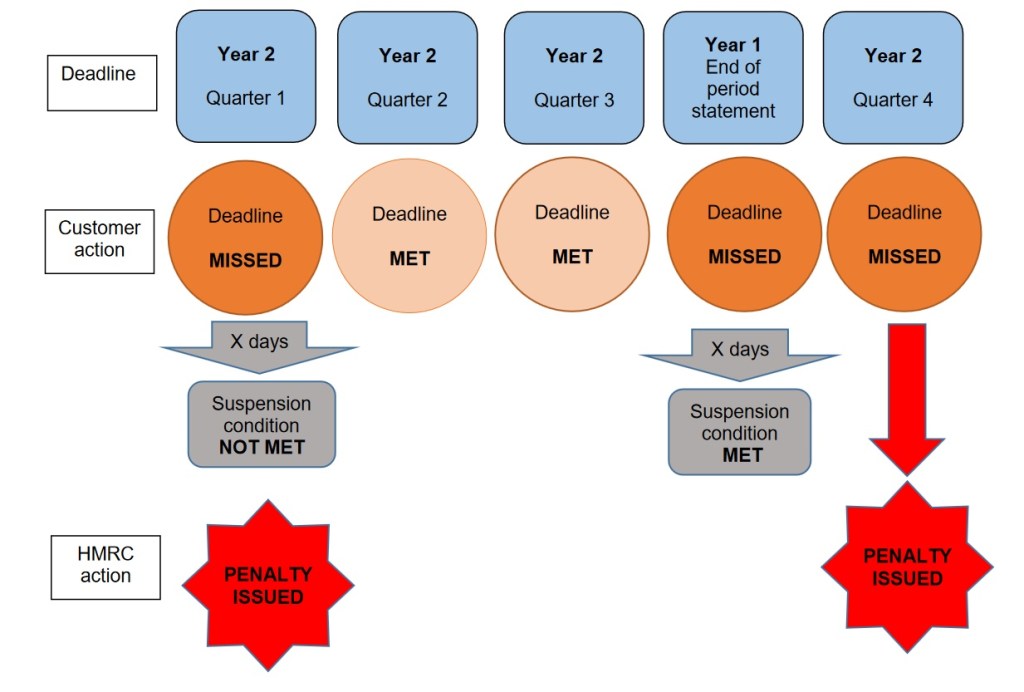

Model C – Suspension with conditions

Read further details at https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/601136/Making_Tax_Digital_-_sanctions_for_late_submission_and_late_payment.pdf